- Coupon

- Language

- Help

- Contact Us

Last Modified: June 10, 2025

For in-stock orders, processing will begin promptly once Elecbee has received your payment. Orders typically require a few business days for processing before shipment.

For backorders, your package will be dispatched only when all items are ready for shipment. We recommend referring to the lead time information provided in your quotation result before proceeding with payment.

Once your order has been picked up by the courier company, you will receive an email notification containing your tracking information.

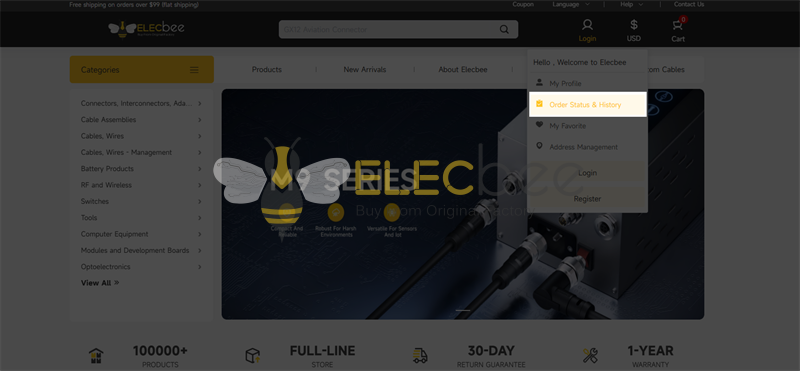

Alternatively, you can always log in to your Elecbee account and track your order directly on the Order History page.

Last Modified: June 10, 2025

Should you need to change the shipping or billing address after placing an order, please contact us immediately via email at service01@elecbee.cn, providing your Elecbee order number and the new address details.

Please note that if your order has already been shipped out, Elecbee cannot guarantee a successful change of the shipping address. Therefore, we strongly advise you to double-check all address information carefully before submitting your order online. If the package has already arrived in the destination country, you may consider contacting the local courier office or post office directly to inquire about changing the shipping address.

Note: Changing the shipping address may incur additional charges. Any such additional charges will be borne by the customer.

The Incoterms for Elecbee orders are typically FCA (Free Carrier, freight-prepaid) or EXW (Ex Works, freight-collect). Customers are responsible for paying any amounts charged by government authorities or customs at the destination. This includes, but is not limited to, duties, taxes, and any additional fees levied by the courier company. Elecbee will not be held responsible for any extra charges once the original package has been shipped.

As customs policies vary widely by country, Elecbee is unable to advise on specific costs. Therefore, we recommend contacting your local customs office or the corresponding logistics company for more detailed information.

Customs requirements differ significantly in each country. Please include any specific Customs requirements necessary when placing your order; Elecbee will provide as much support as possible.

If a customer refuses to pay the above-mentioned charges, the return shipping costs and any additional fees incurred will be deducted from the order amount, and any remaining funds will be refunded.

Attention:

-

Customs offices in some countries or regions require the importer to provide a particular form of identification before releasing a shipment. You may be required to provide an identification number such as a Unique Identification Number, GST number, Business registration number, or Tax ID. If you have such a Tax number, please provide it in the shipping address information for further shipping arrangements.

-

Some countries/regions that require an identification number or an ID picture or passport picture of the consignee include: Taiwan (China), India, Brazil, Turkey, South Korea, Chile, Ecuador, Israel, Peru, Qatar, and South Africa. This also applies to cases where logistics providers may require further verification of the recipient's name. Elecbee customer service staff will contact you when needed.

-

India: All shipments to India require consignees' KYC documents (Government recognized Identity and Address proof) to be presented to Customs during shipment clearance. Import clearance cannot start unless KYC documents and authorization approvals are uploaded on www.kyc.india.express.dhl.com.

For packages including chips, India customs will require a CHIMS (Chip Imports Monitoring System) registration certificate. The CHIMS requires importers to submit advance information on www.imports.gov.in for the import of items and obtain an automatic Registration Number by paying the registration fee. Importers shall have to enter the Registration Number and expiry date of Registration in the Bill of Entry to enable the clearance of consignments.

To change the shipping method for your order, please contact us via email at service01@elecbee.cn. Kindly provide your Elecbee Order Number and specify the new shipping method you wish to update to.

Please be aware that changing the shipping method may result in a difference in shipping costs. Any additional charges incurred will be borne by the customer.

Note: Elecbee cannot change the shipping method if the package has already been shipped out.

Elecbee offers a variety of reliable shipping methods to meet your delivery needs. The available options for your order will be displayed during the checkout process. Our supported shipping carriers and services include:

- DHL

- UPS

- FedEx

- SF Express

- Belgium Post

- Global Direct Standard Line

- Registered Mail

The shipping cost for your order is dynamically calculated and varies based on several key factors:

- Weight: This includes the total weight of your items and packaging.

- Shipping Method: Different carriers and service levels (e.g., express, standard) have varying costs.

- Destination: Shipping costs differ based on the country and region your order is being delivered to.

Note: Any estimated weight provided is for reference only. The final shipping cost will be based on the actual gross weight measured by the weighing scale as indicated on the packing list.

Should you notice any discrepancies in weight or calculated shipping costs, please do not hesitate to contact us via email at service01@elecbee.cn.

(0 Items)

It is empty.

0

0